📉 Analysis of Indian Ponzi Scams

Ponzi scams have repeatedly harmed millions of Indians—especially middle-class, rural, elderly, and financially illiterate investors. Below is a clear, structured analysis covering how they work, why they spread, major cases, impacts, and solutions.

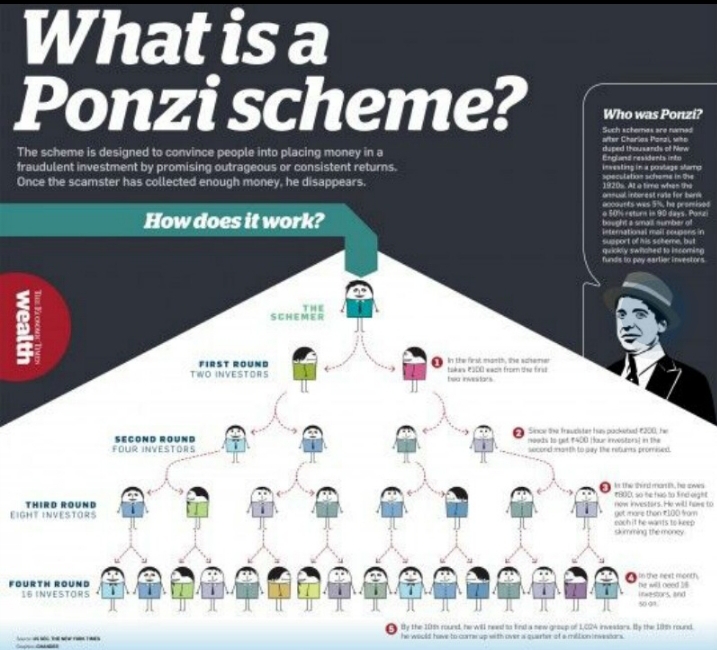

🔍 What Is a Ponzi Scheme?

A Ponzi scheme is a fraudulent investment model where:

Returns to old investors are paid using money from new investors

There is no real business or profit

The scheme collapses when new inflows stop

🇮🇳 Why Ponzi Scams Flourish in India

1️⃣ Low Financial Literacy

Many people lack awareness of banking, mutual funds, or regulated investments

Guaranteed “double money” promises seem attractive

2️⃣ Trust-Based Selling

Agents are often:

Relatives

Local leaders

Religious or community influencers

Victims invest due to social pressure and trust

3️⃣ Regulatory Gaps & Delay

Overlapping jurisdiction between state police and SEBI

Slow legal processes allow scams to grow unchecked

4️⃣ High Unemployment & Inflation

People seek quick, passive income

Scammers exploit financial stress

🧨 Major Ponzi Scams in India

🔴 Saradha Group (2013)

Loss: ₹25,000+ crore

Victims: ~1.7 crore

Region: West Bengal, Odisha, Assam

Used media companies & chit funds as cover

🔴 Sahara India

Illegal fundraising via bonds

₹24,000+ crore stuck

Millions awaiting refunds (even in 2025)

🔴 Rose Valley, Speak Asia, PACL

Targeted rural & semi-urban India

Promised land, tourism, survey income

👥 Who Suffers the Most?

Daily wage workers

Pensioners

Women self-help groups

Minority & migrant communities

Persons with disabilities (PwDs)

Many victims sell land, gold, or take loans—leading to lifelong debt.

⚠️ Common Red Flags

🚩 Guaranteed high returns (10–30% monthly)

🚩 No clear product or business model

🚩 Pressure to recruit others

🚩 Cash-based collections

🚩 No SEBI registration

Golden Rule: If it sounds too good to be true—it is.

🏛️ Government & Legal Response

Banning of Unregulated Deposit Schemes Act, 2019

ED & CBI investigations

Supreme Court-monitored refunds (e.g., Sahara)

Still slow recovery & poor conviction rates

🛠️ Solutions & Prevention

✅ Strengthen Financial Education

School & community-level awareness

Content in regional languages & sign language

✅ Faster Regulation

Single-window reporting system

Real-time tracking of suspicious schemes

✅ Community Reporting

Encourage whistleblowers

Protect informants

✅ Promote Safe Alternatives

Post Office schemes

Bank fixed deposits

SEBI-regulated mutual funds

📌 Conclusion

Ponzi scams in India are not just financial crimes—they are social tragedies. Until financial literacy, trust awareness, and enforcement improve together, vulnerable citizens will remain at risk.

Leave a comment