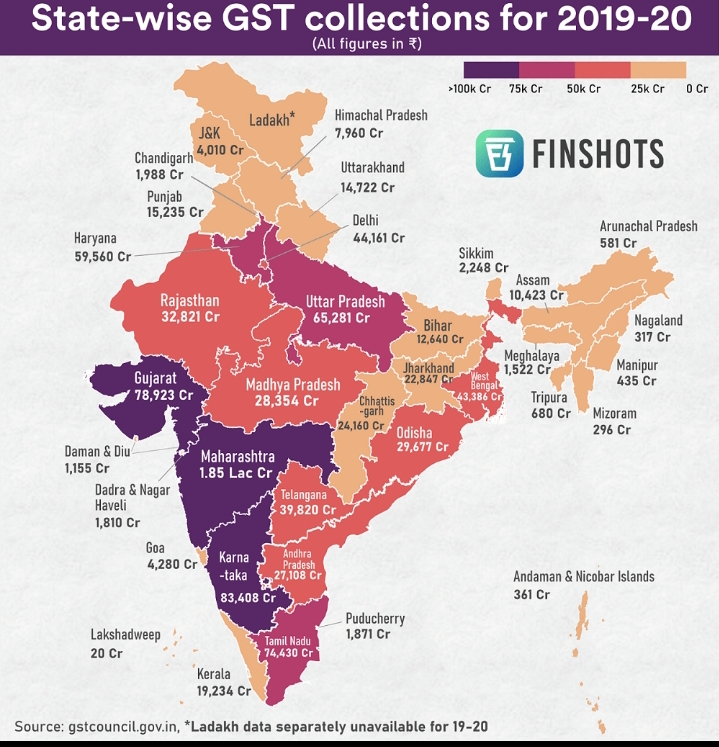

Summary: Indian States’ GST Tax Revenue Contribution to the Indian Government

- GST (Goods and Services Tax) is one of India’s largest sources of tax revenue, shared between the Central Government (CGST & IGST) and State Governments (SGST).

- GST revenue is highly concentrated in a few economically strong states due to higher industrial activity, services, trade, and consumption.

Top GST-Contributing States

- Maharashtra – largest contributor, driven by Mumbai’s financial services, manufacturing, and imports.

- Karnataka – strong IT, startups, and services sector.

- Gujarat – major manufacturing, ports, and exports hub.

- Tamil Nadu – automobile, electronics, and industrial base.

- Haryana – automobile, logistics, and corporate hubs.

- Uttar Pradesh – large population and rising consumption base.

Together, these states contribute over 65–70% of India’s total GST revenue.

Medium Contributors

- Delhi, Telangana, West Bengal, Rajasthan, Andhra Pradesh, Odisha

- These states benefit from services, mining, trade, and urban consumption.

Lower GST Contributors

- Bihar, Jharkhand, Chhattisgarh, North-Eastern states, hill states

- Lower industrialization, smaller markets, and higher dependence on central transfers.

Key Observations

- Western and Southern India dominate GST collections.

- States with formal economies, ports, IT hubs, and manufacturing clusters generate higher GST.

- Consumption-based tax nature benefits populous and urbanized states.

- Many poorer states receive more GST compensation and central transfers than they contribute.

Overall Conclusion

India’s GST revenue reflects economic inequality between states. While developed states fund a major share of national GST, redistribution through GST settlement and Finance Commission transfers helps support less-developed states, maintaining cooperative federalism.

Leave a comment