Building a ₹1 lakh (or ₹1,000 equivalent) emergency fund in six months on a tight budget is entirely achievable with consistent planning, cost control, and smart micro-investments. Following recent 2025 financial advisories from Indian platforms and banks, here is a practical roadmap.

Step-by-step 6-month emergency fund plan

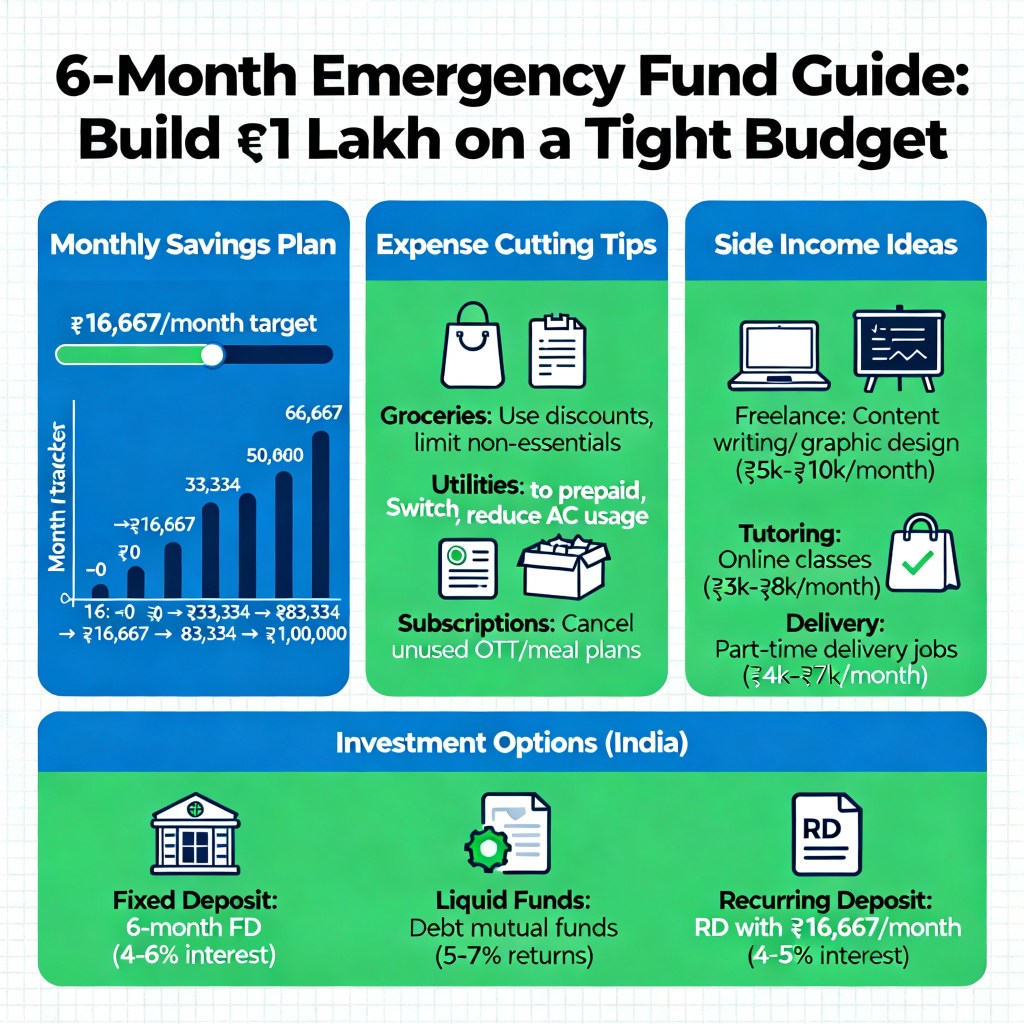

Set a clear savings goal:Your target is ₹1,00,000 in 6 months. This translates to ₹16,700 per month, or about ₹550 per day. If the goal feels too heavy, start smaller—₹500 to ₹1000 weekly—and gradually ramp up as your discipline strengthens �.

List essential monthly expenses : Record only necessities—rent, food, utilities, EMIs, and medicine. Base your goal on what keeps your basic life stable for 3–6 months of emergencies ��.

Use the 50-30-20 or 60-30-10 rule:

Spend 50–60% of your income on needs, 30% on wants, and save 10–20% for your emergency goal. Automate this monthly via recurring deposits or apps like Groww, Paytm Money, or Kuvera �.

Select short-term, safe investment tools:Instead of letting cash sit idle, use these six-month savings options ��:

Recurring Deposit (RD): Starts as low as ₹500 monthly, 4–8% annual return.

Liquid mutual funds: Offer 2–6% returns, redeemable within 1–2 days.

Post Office Time Deposit (6 months): Government-backed, ~7% interest.

Treasury Bills (91-day): 5–7% secured return with low risk.

Cut and redirect daily spending leaks: Avoid food delivery, subscriptions, and impulse buys.Cook at home and buy in bulk.Use cashback apps and government-discount portals (e.g., ONDC partners) ��.

Reinvest every ₹100–₹200 saved weekly into your RD or wallet fund.Boost cash flow with side income:Take on small freelance tasks, resell products online, tutor, or use survey/micro-work apps. Even ₹2,000–₹3,000 earned monthly directly reduces the pressure on your core income �.

Insurance and debt security:Before saving aggressively, ensure affordable health cover (₹10 lakh floater plan). This prevents medical expenses from eating into your progress �.

Example 6-month saving breakdown (aiming ₹1 lakh)

Key tips Treat this as a non-negotiable monthly payment.Keep your fund in a separate, liquid account—never mix with regular savings ��.

Once you reach ₹1 lakh, pause and switch to maintaining it through slow monthly top-ups and inflation adjustment.This plan balances savings automation, lifestyle streamlining, and short-term investment safety—helping anyone on a modest income achieve the ₹1 lakh emergency cushion within six months.

Leave a comment