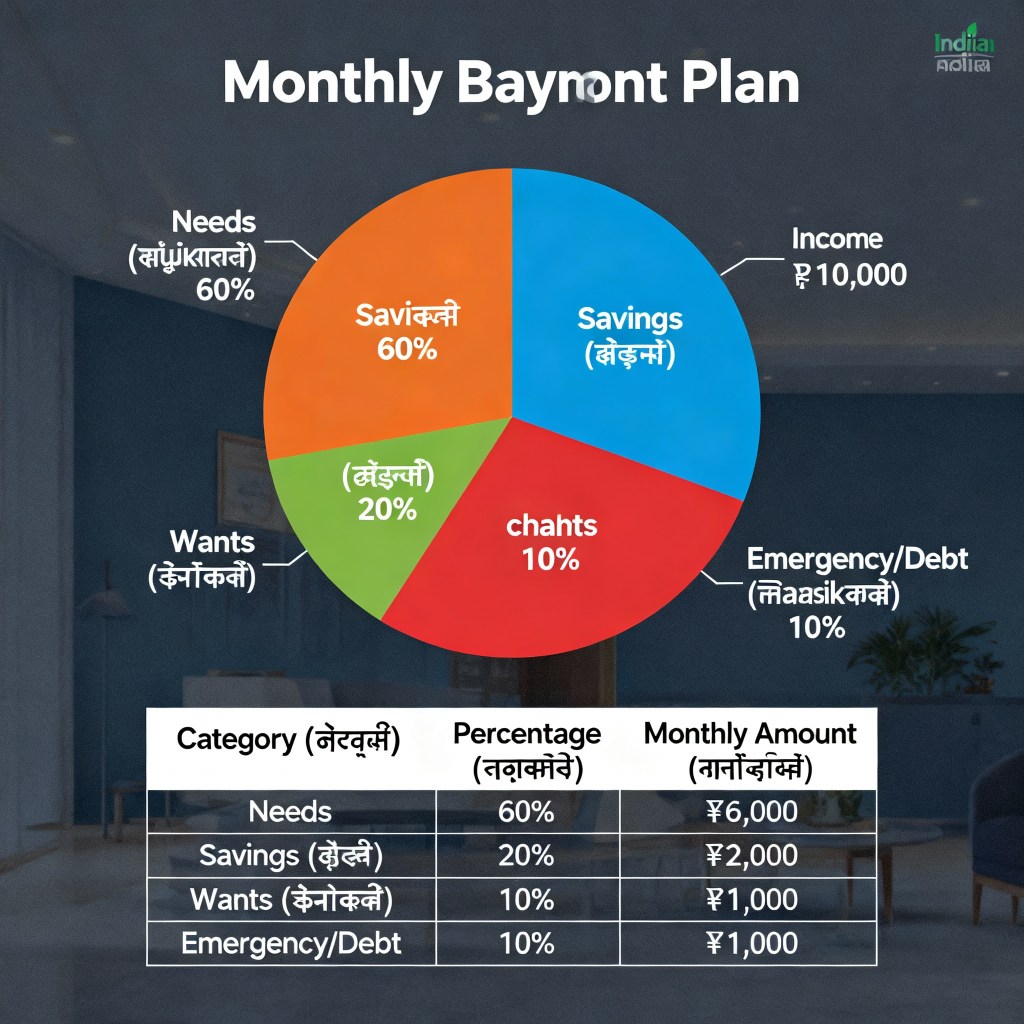

Here’s a simple and practical monthly budget plan tailored for an Indian household with an income of ₹10,000 or more. The structure follows a modified 50-30-20 approach adjusted for low-income flexibility, inspired by recommended strategies from Indian financial experts ���

How to Apply This Monthly

Separate Needs First

Transfer ₹6,000 for essentials like rent, groceries, and local travel. Keeping this budgeted in cash or a separate account works well ��.

Automate Savings

On the same day you receive your income, set aside ₹2,000 directly into a recurring deposit (RD) or SIP so you’re not tempted to spend it ��.

Control Desires and Subscriptions

Limit online spending, small UPI transactions, and streaming memberships to ₹1,000 total for the month �.

Create an Emergency Pocket

Use ₹1,000 for medical needs or emergencies. If unused, roll it into savings or a health fund next month �.

Optional Improvement Ideas

When income increases (say ₹12,000–₹15,000), maintain the percentage ratios so savings grow proportionally.

Use apps like Walnut, Money Manager, or Google Sheets to track every rupee you spend �.

If ₹2,000 savings feels tight, start with ₹1,000 and increase it gradually as expenses stabilize �.

Review your spending at the end of each month and adjust your grocery or transport costs to stay within limits ��.

This plan ensures basic living comfort while building a savings habit even with modest income growth.

Leave a comment