Here are five practical tips to reduce your monthly expenses without sacrificing quality of life, supported by current expert advice and financial coaches.Review and Cancel Unused Subscriptions

Audit your monthly subscriptions for streaming services, magazines, or apps and cancel the ones you don’t use regularly����.

Often, users underestimate how much they spend on small recurring charges that add up over time, so reviewing your bank statements or subscription lists can reveal savings opportunities���.

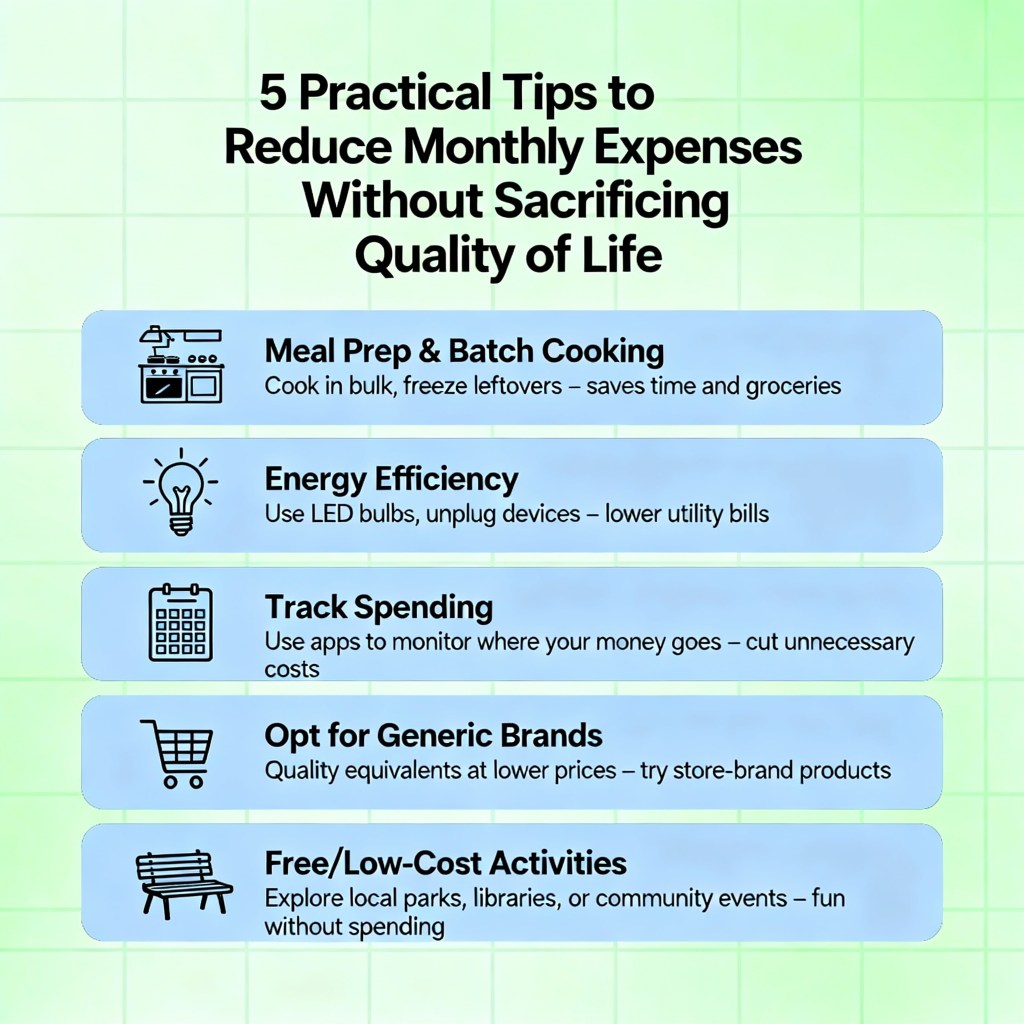

Cook More at Home and Plan Meals Dining out or ordering food frequently can put a big dent in your budget. Cooking at home and planning your meals for the week helps you save significantly while enabling you to enjoy healthier, home-cooked versions of your favorite dishes���.

Batch cooking and using leftovers creatively can further increase your savings�.Track Spending and Stick to a Budget

Use a budgeting app or spreadsheet to track all your expenses and income; this awareness alone often helps people make better choices���.

Set a realistic monthly budget and follow the 50-30-20 rule: allocate 50% for needs, 30% for wants, and 20% for savings�.

Shop Mindfully and Use Discounts Before making a purchase, compare prices, seek out discounts, and use shopping lists to avoid impulse buying����.

Shopping during sales or exploring second-hand options for clothing, gadgets, or furniture can also yield substantial savings without lowering your standard of living��.Reduce Utility and Energy CostsSmall adjustments—like using LED bulbs, turning off appliances when not in use, and moderating air-conditioning—can lead to lower electricity bills without impacting comfort at home��. Reviewing your mobile, cable, or broadband plans for better rates or necessary downgrades also helps lower monthly outflows��.Adopting these habits allows you to spend less without missing out on the things you value, making your finances healthier while maintaining a high quality of life�����.

Leave a comment