A significant proportion of Indian farmers either do not have crop loss insurance or face major obstacles in effectively using it, leaving them vulnerable to income shocks from natural disasters and climate change.

Scope of Crop Insurance Coverage

- Only a fraction of India’s 80 million active cultivators are covered by schemes like PMFBY (Pradhan Mantri Fasal Bima Yojana), despite efforts to expand reach since 2016.

- Around two-thirds of farmers, especially small and marginal ones, remain uninsured against crop losses as of 2025.

- Some major agricultural states such as Punjab, West Bengal, and Bihar have opted out or implemented alternative models, further reducing coverage.

Key Reasons for Low Adoption

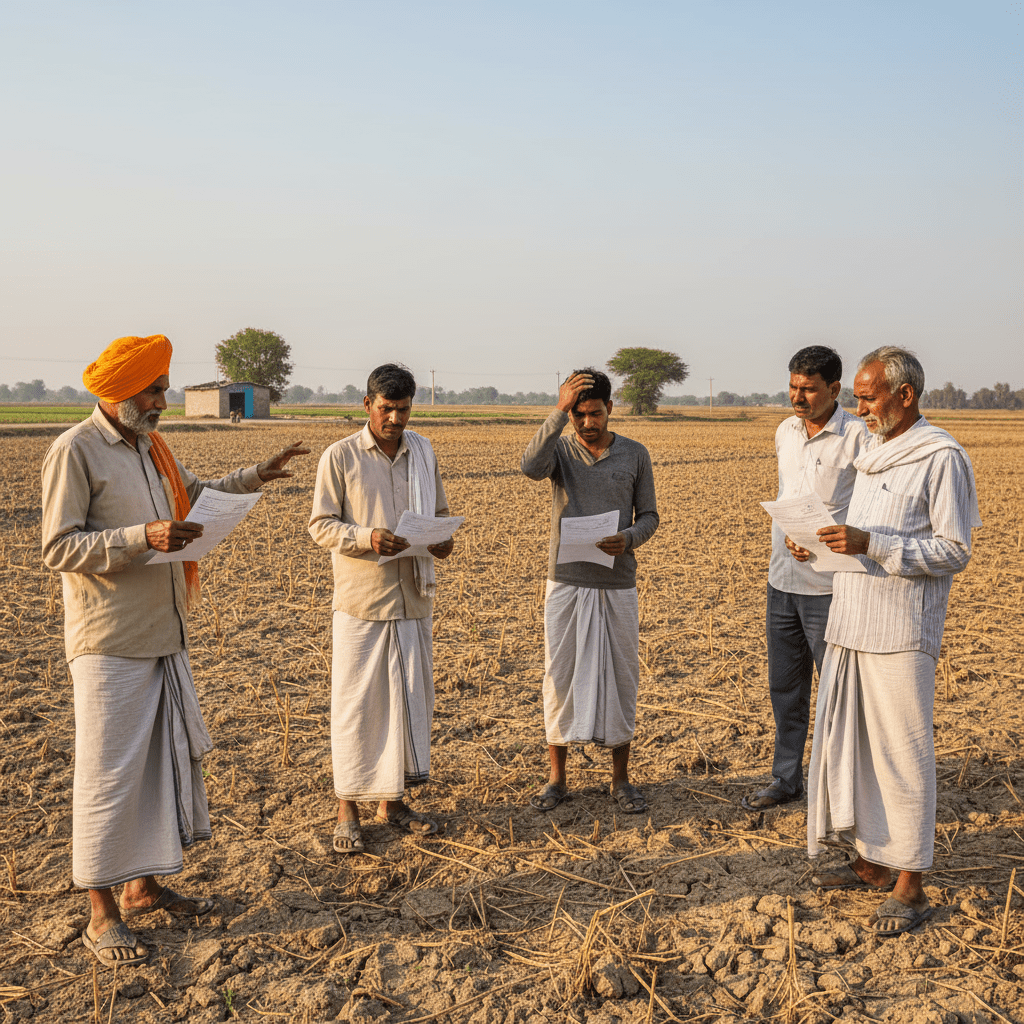

- Lack of Awareness: Many farmers are not aware of existing crop insurance schemes, particularly in remote and underserved regions.

- Complex Procedures: Enrollment and claims often involve complicated paperwork and bureaucracy, deterring participation.

- Delayed Claim Settlements: Insurance payouts are often slow, which erodes trust in the system and makes it less attractive to risk-averse farmers.

- Economic Barriers: Small and marginal farmers struggle to afford premiums, even when subsidized, and liquidity/credit constraints play a major role.

- Coverage Issues: Schemes use an “area approach” instead of farmer-level assessments, sometimes leaving individual losses uncompensated.

State-Level and Structural Challenges

- States must contribute to subsidy costs, which can be hard to justify when claim ratios are low in normal years, leading many states to withdraw or suspend participation.

- Some regions (e.g., Jammu & Kashmir horticultural districts) have no coverage due to failed tender processes or insurance providers withholding service.

- Absence of a state or center-supported structured policy further exacerbates vulnerability, especially amid frequent extreme weather events.

Farmer Attitudes and Preferences

- Farmers tend to prefer direct relief payments when disasters strike, found these more reliable and faster than insurance payouts.

- Willingness to pay exists among some segments, but satisfaction hinges on timely, simple settlement and clear coverage periods.

Opportunities for Improvement

- More farmer education, targeted extension programs, and simplified digital onboarding can help boost adoption and usage.

- Policy reform towards farmer-level coverage and streamlined claims processing is crucial to protect the majority currently uninsured.

In summary, most Indian farmers still lack practical crop insurance or are unable to access its benefits effectively, mainly due to low awareness, economic barriers, bureaucratic complexity, delayed payments, and uneven state participation in schemes.

Leave a comment