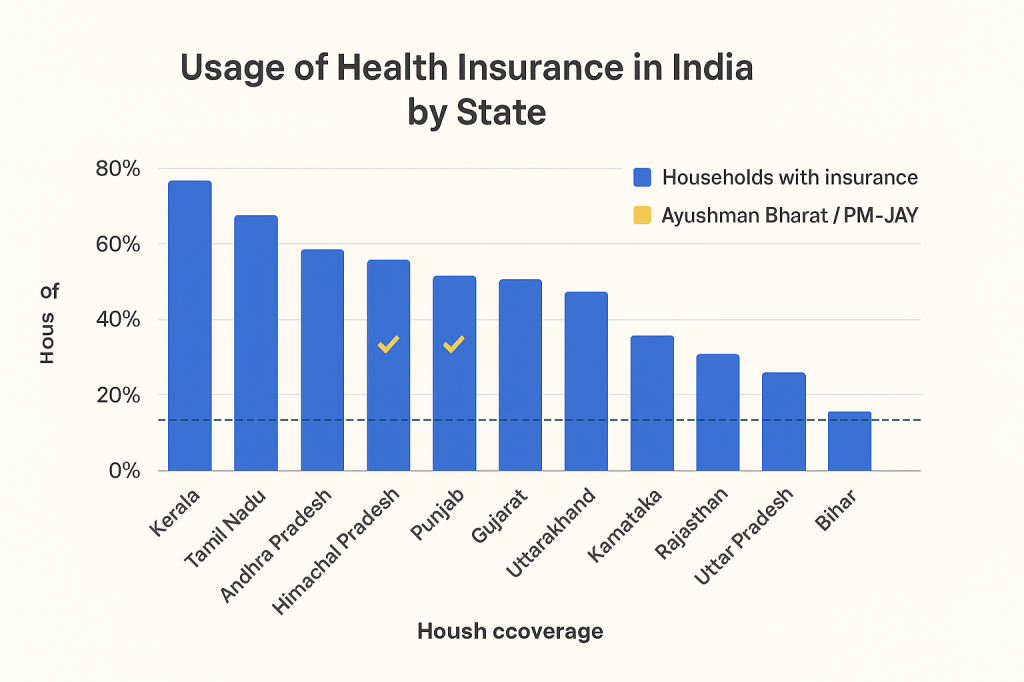

Health insurance coverage in India varies widely across states, with substantial regional disparities in the number of people protected by health insurance schemes.

Statewise Coverage Rates

Highest Coverage: Rajasthan leads with 88% of families having at least one member covered. Andhra Pradesh follows at 80%.

Other High-Performers: Goa (73%), Chhattisgarh (71%), Telangana (69%), Assam (67%), and Kerala (58%) show high coverage.

Low Coverage States: Jammu & Kashmir (14%), Bihar (17%), Maharashtra (22%), Nagaland (22%), Sikkim (28%), and Delhi (25%) have significantly lower coverage.

Recent Table of Coverage by State

State % of Families With Insurance

Rajasthan 88%

Andhra Pradesh 80%

Goa 73%

Chhattisgarh 71%

Telangana 69%

Assam 67%

Kerala 58%

Mizoram 50%

Gujarat 44%

Himachal Pradesh 39%

Tripura 36%

West Bengal 34%

Karnataka 32%

Sikkim 28%

Delhi 25%

Nagaland 22%

Maharashtra 22%

Bihar 17%

Jammu & Kashmir 14%

Government Schemes: Ayushman Bharat (PMJAY) and state-sponsored schemes have been primary contributors to coverage expansion, targeting low-income and vulnerable groups.

Corporate/Employer Insurance: Employer-based insurance covers only a small portion of the population, mostly in formal sectors.

Private Insurance: Highest uptake of privately purchased schemes is observed in wealthier states, e.g., Gujarat.

Penetration and Unmet Needs

National Penetration: As of 2025, only about 37% of India’s population is covered by any health insurance.

Rural vs Urban: Urban areas tend to have higher coverage thanks to better awareness and access, while many rural and unorganized sector workers remain uninsured.

Challenges: Awareness and willingness to buy insurance remain low, especially in states with minimal government schemes.

Claims and Financial

Claims Paid: Rajasthan, Kerala, and Tamil Nadu are leading in claims paid under government schemes.

Premium Collection: Maharashtra leads gross premium collection, indicating high value policies or larger insured population.

Growth: The market is expanding rapidly, with innovative insurance platforms and government focus on rural inclusion.

Conclusion

There is significant inequality in health insurance coverage across Indian states, with some states approaching near-universal coverage, while others lag far behind, primarily due to differences in awareness, government scheme effectiveness, and socio-economic conditions.

Leave a comment