Quick executive summary

Multi-level marketing (MLM) in India sits on a spectrum from legitimate direct selling to fraudulent pyramid / Ponzi operations. Over the last decade and continuing into 2024–2025, India has seen repeated large-scale MLM/Ponzi collapses and frequent arrests across many states (Gujarat, Maharashtra, Telangana, Uttar Pradesh, Bihar, Andhra Pradesh, Jharkhand etc.). Enforcement is fragmented — state police, ED/PMLA, SEBI (when collective-investment features exist) and consumer forums all get involved. Key legal tools include the Prize Chits & Money Circulation (Banning) Act, 1978, PMLA and consumer protection law. �

Hindustan Times +3

What “MLM scams” commonly look like (definitions & patterns)

Legitimate MLM (direct selling): commissions tied to actual sale of goods/services and transparent payout plans.

Pyramid / money-circulation schemes: rewards primarily for recruiting others, not for product sales — these collapse when recruitment stalls.

Ponzi-style MLM: early investors get paid from money of later investors; often hidden by fake dashboards, apps or forged statements. Typical lures: “guaranteed high returns,” referral bonuses, pressure to invest quickly. �

TaxTMI +1

Recent trends & sample cases (state-level flavor)

Gujarat / Ahmedabad / Surat: multiple recent cyber-investment and MLM-style fraud arrests involving fake trading apps, WhatsApp lures and franchise promises; large sums (tens to hundreds of crores) and pan-India victim lists reported. Example: an ₹800-cr mall-franchise fraud and other cyber-investment arrests traced to Gujarat. �

The Times of India +1

Telangana / Hyderabad: state CID/Crime Investigation arrests of operators running online MLM investment schemes; investigations show classic online recruitment and commission structures. �

Telangana Today

All-India historical examples (illustrative): SpeakAsia (massive online survey/MLM fraud affecting millions) remains a landmark case showing cross-border promoters, huge investor numbers and long legal processes. Such historical failures still inform current investigations. �

Hindustan Times +1

Bottom line: fraudulent schemes often operate centrally (management may be in one state) while victims and money flows are pan-India. Enforcement therefore involves both state police FIRs and central agencies when money-laundering or interstate commerce is exposed. �

Directorate of Enforcement +1

Why enforcement is hard

Fragmented jurisdiction: state police handle FIRs, but proceeds often cross states/countries — requiring ED / central agencies. �

Directorate of Enforcement

Digital disguise: fraudsters use apps, fake dashboards and social media/WhatsApp to simulate legitimacy (fake KYC, forged documents). Recent arrests explicitly cite these tactics. �

The Times of India +1

Delay & complexity: big cases (SpeakAsia-type) involve lengthy investigations and courts, leaving victims waiting for restitution. �

Hindustan Times

Red flags to spot a scam (practical checklist)

Promise of guaranteed high returns with low/no risk.

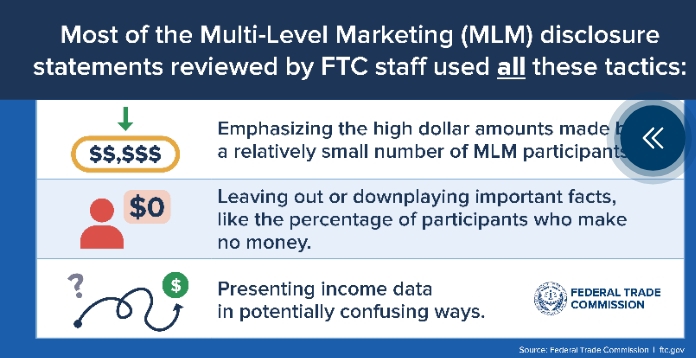

Rewards primarily for recruiting rather than product/service sales.

Pressure to pay up front and to recruit quickly.

Use of fake apps/dashboards showing fabricated profits.

No verifiable product, or product sold at inflated prices mainly to justify commissions. �

The Times of India +1

Steps for victims & consumer action

File FIR at local police station immediately (capture chats, receipts, bank transfers).

If money moved across states / is large / suspect laundering, inform ED / PMLA cell and file complaint with Cyber Crime / Economic Offences wing. �

Directorate of Enforcement

Lodge complaint with SEBI if the scheme claims investment/market returns, and with RBI if bank accounts/payment rails were misused.

Preserve evidence: screenshots, bank statements, UPI/NEFT IDs, WhatsApp groups and payment recipient account details.

Consider consumer court / civil suit for recovery (parallel to criminal complaints).

(These steps reflect recurring advice seen in recent enforcement reports and case coverage.) �

The Times of India +1

Policy & prevention recommendations (what governments / platforms should do)

Unified registry of direct-selling companies and compulsory disclosure of compensation plans.

Faster joint task forces (state police + central agencies + cyber cells) for rapid action on digital MLMs.

Mandatory KYC / AML checks and transaction monitoring for payments linked to suspicious MLMs; payment platforms should flag unusual flows.

Public awareness campaigns focused on WhatsApp/social media recruitment tactics and fake app dashboards.

These suggestions follow the structural problems observed across multiple reported cases. �

TaxTMI +1

Shortcomings in what I could (and could not) find quickly

I surveyed multiple recent news reports (state news, national outlets) and regulatory summaries to identify patterns and example arrests; however, there is no single authoritative public database that lists every MLM complaint by state and amount — reporting is fragmentary across media and police/ED releases. For precise state-by-state counts and a victim registry you’d need access to consolidated FIR/ED/SEBI case lists or a government parliamentary reply dataset. �

Directorate of Enforcement +1

Leave a comment