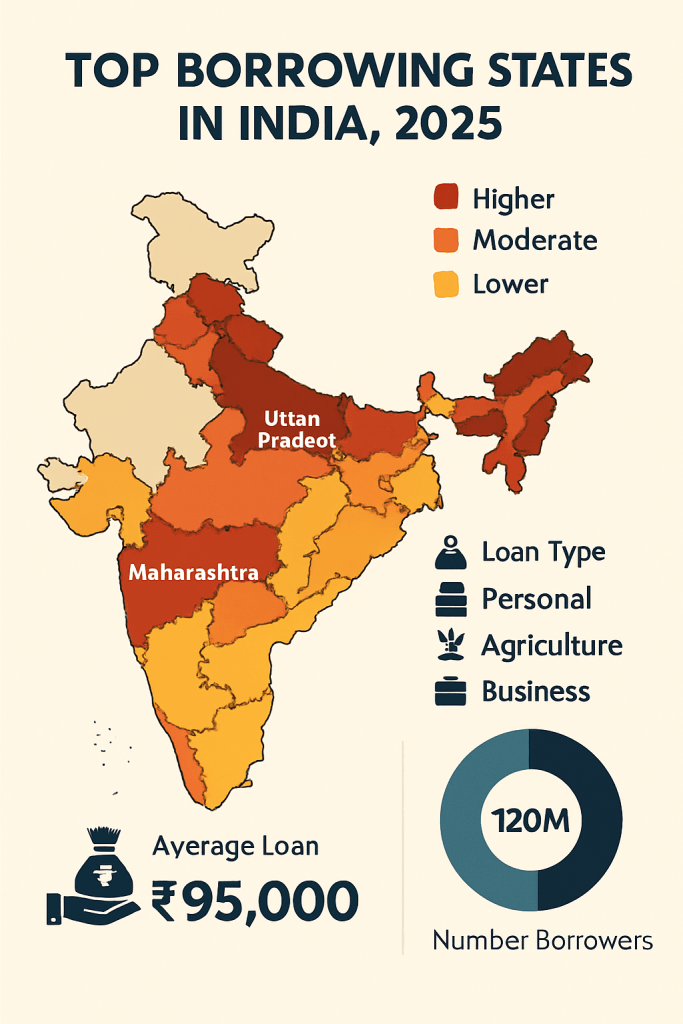

Indian states show significant variation in loan borrowing and indebtedness, both among individuals and at the government level, with states like Tamil Nadu and Maharashtra being the largest borrowers, while high debt ratios are recorded in Punjab, Himachal Pradesh, and several North-Eastern states.

State-Wise Borrowing Patterns

Tamil Nadu led all states in market loan borrowings for the fifth consecutive year in FY2025, raising over ₹1 lakh crore in one year alone.Maharashtra followed Tamil Nadu, also consistently being a top borrower and the leader in loan repayments (₹1.2 lakh crore repaid since FY2021).Other major borrowing states include Uttar Pradesh, Karnataka, West Bengal, and Andhra Pradesh, accounting for over half the total state market borrowings since FY2021.Debt-to-GSDP Ratios

States facing the highest debt-to-GSDP ratios in 2025 include Punjab (44.1%), Himachal Pradesh (42.5%), Arunachal Pradesh (40.8%), Nagaland (38.6%), and Meghalaya (37.9%).Over the past decade, states such as Bihar, Andhra Pradesh, Chhattisgarh, Haryana, Kerala, Punjab, Rajasthan, Tamil Nadu, and Telangana have added more than 10 percentage points to their debt-to-GSDP ratios.

Personal Loan Distribution (2023–2024)

Northern Region: ₹8.16 lakh crore in personal loans outstanding.

Haryana: ₹1.92 lakh crore, Delhi: ₹1.88 lakh crore, Rajasthan: ₹2.10 lakh crore, Punjab: ₹1.19 lakh crore.

North-Eastern Region: ₹1.09 lakh crore outstanding, showing relatively lower borrowing compared to larger states.

Mudra Loan Disbursements (2015–2025)States with highest disbursement include Uttar Pradesh (₹3.67 lakh crore), Tamil Nadu (₹2.98 lakh crore), Maharashtra (₹2.55 lakh crore), and West Bengal (₹2.17 lakh crore), covering millions of loan accounts.These figures highlight both the scale and reach of individual borrowing, with some regions lagging behind due to structural or economic constraints.

Regional Trends and Insights

Borrowing costs have reached new highs in 2025, with states facing average market loan (SDL) costs of 7.69%, reflecting increased investor risk appetite and state fiscal deficits.States with higher fiscal deficits and contingent liabilities tend to have rapidly rising debt ratios, increasing long-term financial risk and pressure on government finances.

Key Takeaways

Tamil Nadu and Maharashtra top state-level borrowing, while Punjab leads in debt ratio increases, reflecting growing fiscal challenges and disparities across regions.There is notable heterogeneity in debt increases, with several states showing either disciplined fiscal management or significant financial stress over the past decade.The scale of personal and Mudra loans reflects both robust credit markets and ongoing disparities in economic development across Indian states.

Leave a comment