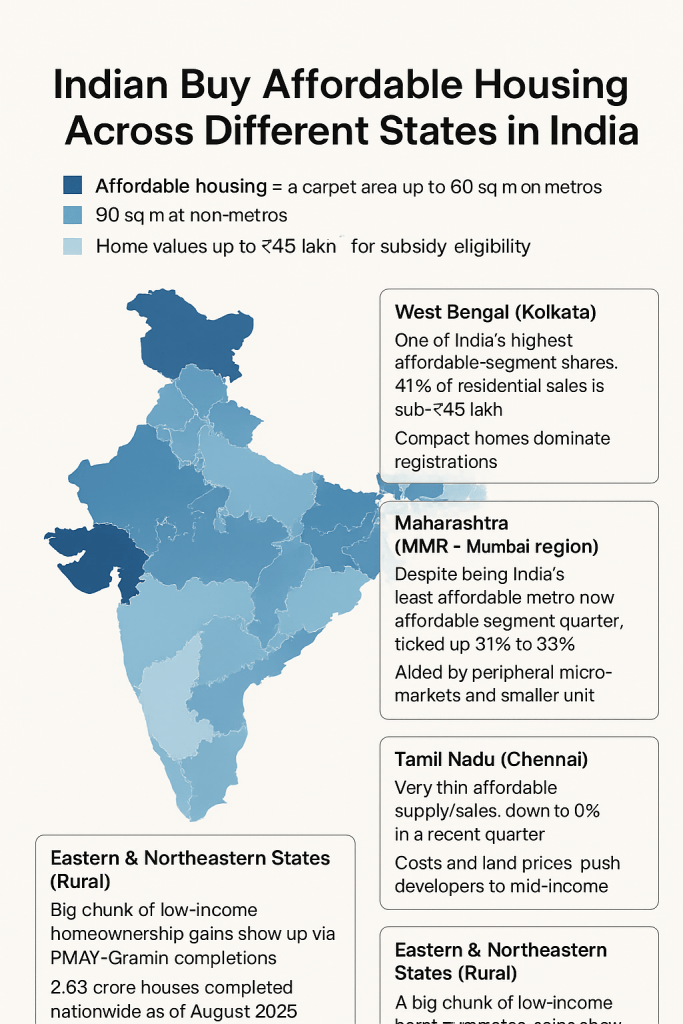

India’s affordable housing market is facing a major supply crunch, with a steep drop in new launches and widening demand-supply gap, especially in urban centers. The most affordable states and cities now are largely concentrated in Ahmedabad, Pune, and Kolkata, while metros like Mumbai and Delhi-NCR have seen a sharp decline in affordable housing supply and rising EMIs relative to income.Key Trends by State and City

Steep Decline in Affordable Housing Supply: From 2018 to mid-2025, the share of new homes priced below ₹50 lakh in India’s top eight cities dropped from 52.4% to just 17%. Supply-to-demand ratio has fallen drastically, with only about one affordable home delivered for every three in demand in 2025.Highest Demand,

Greatest Shortage: Uttar Pradesh accounts for about 20% of India’s total affordable housing shortage, followed by Maharashtra, West Bengal, and states with large Tier 2/3 cities.

Metro City Comparisons:Ahmedabad, Pune, Kolkata: These cities remain the most affordable, due to lower EMI-to-income ratios (well below 40%). Ahmedabad tops the index with an 18% EMI-to-income ratio,

while Pune is at 22% and Kolkata at 23%.Mumbai and Delhi-NCR: These metro areas have seen affordability worsen, with Mumbai having an EMI-to-income ratio as high as 48%, making home ownership almost unreachable for most middle-income households. Supply in these cities has plummeted up to 60% since 2022.

Tier 2 Cities Rising: Cities like Lucknow, Surat, Indore, Coimbatore, Kochi, Nagpur, and Jaipur are now hotspots for affordable housing due to lower property prices and better state/local policy support.

Major Challenges and Factors

Rising Land Prices: High land costs, especially in city centers, have pushed developers towards premium housing, reducing affordable project launches.Stagnant/Inadequate

Private Investment: Only 8% of residential sector investments have gone to affordable housing in the past decade.Policy and Financial Barriers: Developers struggle with limited access to construction finance, restrictive FSI norms, and slow government approvals.Increase in Cost Burden: EMI-to-income ratios for low- and middle-income categories have risen sharply, making affordability a growing concern even for those able to get a Statewise Affordable Housing Table (2025 Estimates)

Policy Initiatives and Outlook

Government schemes like Pradhan Mantri Awas Yojana (PMAY) and affordable rental complexes have helped sustain overall demand but have not translated into enough new supply.

Experts recommend supply-side solutions: unlocking idle PSU land, FSI rationalization, and subsidised developer finance.SummaryThe affordable housing sector in India is under acute stress, with supply shrinking fastest in metros like Mumbai and Delhi-NCR, moderate affordability remaining in Ahmedabad, Pune, and Kolkata, and Tier 2 cities emerging as new growth hubs. Addressing high land prices, policy reform, and boosting private participation are crucial for meeting future demand and mitigating a serious nationwide shortfall.

Leave a comment