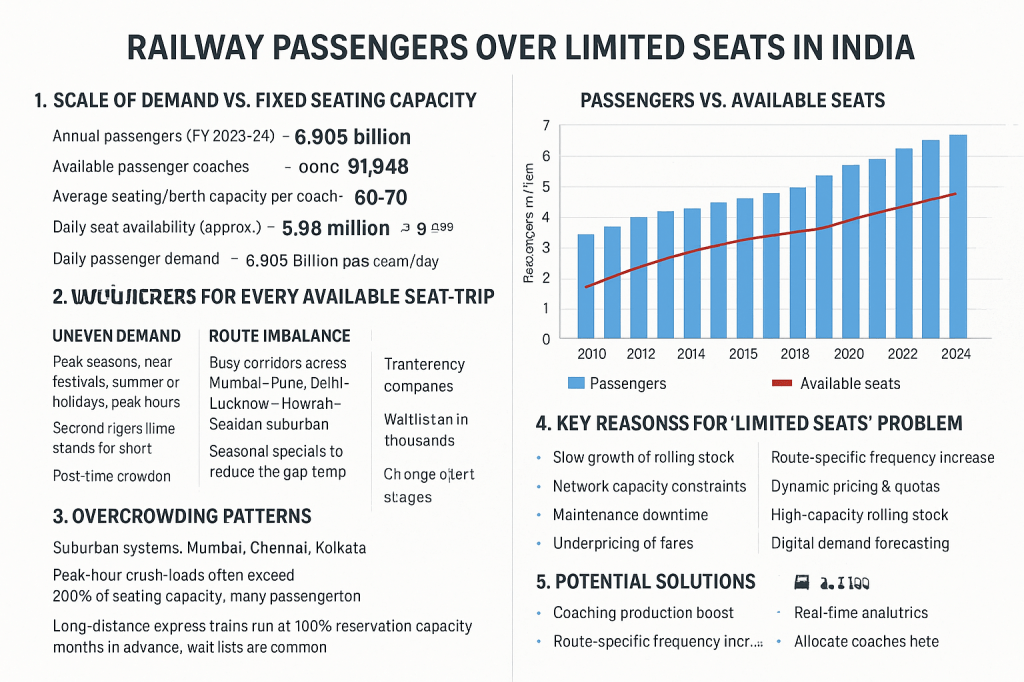

Here’s a clear, numbers-backed analysis of passengers vs. limited seats in Indian Railways, showing why overcrowding is so common and how the mismatch plays out.

1. Scale of demand vs. fixed seating capacity

Annual passengers (FY 2023–24): ~6.905 billion (includes suburban, intercity, and long-distance).

Available passenger coaches: ~91,948 coaches (includes suburban EMUs and conventional trains).

Average seating/berth capacity per coach: ~60–70 (varies by type).

Daily seat availability (approximation):

- 91,948 × 65 seats = 5.98 million physical seats in the network.

- If trains make 1.5 trips/day on average → ~9 million seat-trips/day.

- Daily passenger demand (6.905B ÷ 365) ≈ 18.9 million passengers/day.

Result: ~2 passengers for every available seat-trip on an average day — meaning most seats are used multiple times per day, and many passengers stand.

2. Why the mismatch is worse in reality

- Uneven demand — peak seasons (festivals, summer holidays) and peak hours (morning/evening suburban rush) far exceed average demand.

- Route imbalance — busy corridors like Mumbai–Pune, Delhi–Lucknow, Howrah–Sealdah suburban have chronic shortage, while some low-demand routes have spare seats.

- Coach mix limitation — AC coaches have fewer seats; sleeper coaches are berth-based (usable only for one trip per night); suburban stock turns over faster but still has fixed standing-room limits.

3. Overcrowding patterns

- Suburban systems (Mumbai, Chennai, Kolkata): peak-hour crush loads often exceed 200% of seating capacity — many passengers stand for short trips.

- Long-distance express trains: most popular trains run at >100% reservation capacity months in advance; waitlists in the thousands are common.

- Seasonal specials reduce the gap temporarily but cannot meet sustained surges.

4. Key reasons for “limited seats” problem

- Slow growth of rolling stock — passenger coach production hasn’t kept pace with demand growth.

- Network capacity constraints — limited track slots, congestion at junctions, and priority given to freight on some routes.

- Maintenance downtime — a fraction of coaches are always under repair, reducing active seats.

- Underpricing of fares — low ticket prices encourage more travel demand than the system can comfortably handle.

5. Potential solutions

- Coach production boost — ramp up LHB and EMU manufacturing to expand fleet faster.

- Route-specific frequency increase — more trips where track slots allow, especially on suburban and high-demand intercity routes.

- Dynamic pricing & quotas — spread demand away from peaks, incentivise off-peak travel.

- High-capacity rolling stock — double-decker coaches for certain day routes, higher standing capacity for suburban EMUs.

- Digital demand forecasting — real-time analytics to allocate coaches where they’re needed most.

Leave a comment