Here’s an analysis of Indian retail shops across the country:

🛒 Overview of Indian Retail Shops

Retail Sector Size (2025 est.): $1.5 trillion

Contribution to GDP: ~10%

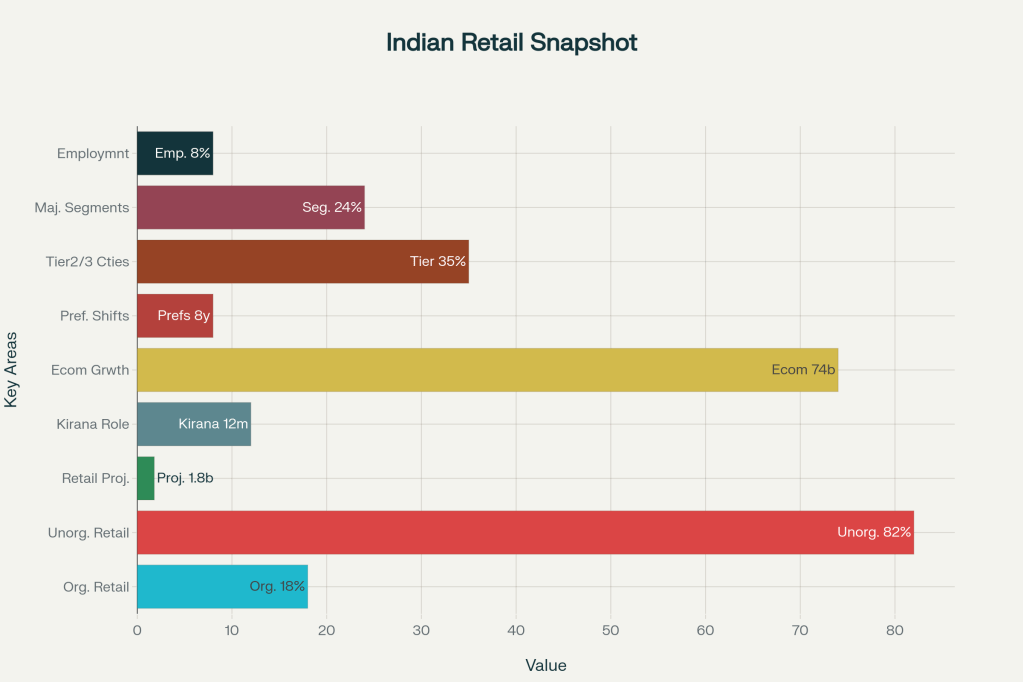

Employment: Over 8% of the Indian workforce (approx. 40 million people)

Types of Retail:

Unorganized sector (85-88%): Kirana shops, street vendors, small general stores

Organized sector (12-15%): Supermarkets, branded chains (e.g., Reliance Retail, DMart, Big B

🧾 Key Trends in Indian Retail

- Digital Integration:

QR codes, UPI payments growing rapidly, even in small towns.

- Growth of Organized Retail:

Reliance Retail, Tata’s Trent, and DMart expanding aggressively.

- Rural Retail Growth:

Demand for FMCG, electronics, and clothing rising in tier-2/3 towns.

- E-commerce Impact:

Flipkart, Amazon, Meesho influencing shopping patterns and competition.

- Franchise Models:

Local retail chains growing via franchisee expansion (e.g., Patanjali, FirstCry, Zudio).

⚠️ Challenges Faced

High Competition: Local shops struggle with modern retail.

Supply Chain Issues: Especially in remote and rural areas.

Changing Consumer Behavior: Shift toward online and bulk purchases.

Rental & Real Estate Costs: Urban retail stores face high operating costs.

📈 Future Outlook

Tier 2 and Tier 3 cities will see massive retail investment.

Hybrid formats like phygital (physical + digital) stores will rise.

Retail tech (inventory automation, POS, loyalty apps) will increase.

Government initiatives like ONDC (Open Network for Digital Commerce) will boost small retailers.

Leave a comment